June 2007

1. History

1.1. Introduction

While European states and the United States were sailing the world on imperial conquests and cementing their dominance over China, India, Australia, Indonesia, and Africa in the first half of the nineteenth century, Japan remained aloof. Any migration was forbidden. Their sole western connection was the Dutch, who were permitted a limited trade monopoly relegated to an artificial island in the bay of Nagasaki.

Europe and North America were developing their capital markets, refining their financial systems. As electric telegraph lines were strung up and railroad locomotives raced between great cities of the West, Japan’s feudalistic system was on the verge of collapse. The decay of the Tokugawa shōgunate was both political and economic, and the latter was much more severe than the former.1

After a series of unwelcome and sent-away Western ships reappeared with an increasing frequency, the demise of the policy of splendid isolation was near. When the American Commodore Perry arrived in 1854 with his “Black Ships,” he was soon followed by the British, the Russians, and the French, forcibly opening Japan for trade. The Japanese, who tried to expel the foreigners who started to trade with the country and use its resources, failed. The shōgunate failed simply, “as a consequence of the inability to find either a peaceful or military solution to the gunboat diplomacy of the Western powers. 2” The rulers of Japan who would restore the Emperor, turned to the ideas and economic systems of the West to establish their policy of fukoku kyōhei, “a rich country with a strong army”3. In short, they desired not only to be immune to foreign domination, but on equal footing with contemporary world powers.

1.2. Before the Bank

Before the Meiji restoration, “there was no system for the accumulation of capital.4” Japan was a feudal country, not only one without the tools of financial instruments such as bonds, annuities, and shares of stock, but without even a common or convertible currency. Without a system of accumulation of capital, private development is nearly impossible. Likewise, the Meiji government sought a path to allow Japan to grow into the 'rich country with a strong arm' that it would become within a half of a century.

During the early years of the Restoration, the government rapidly expanded its physical infrastructure--building harbors, roads, railways, factories, and mines. Some of these endeavors resulted in a financial burden that necessitated their disposal or privatization. In 1880, the government sold 3 shipyards, 51 ships, 10 mines, and 52 factories to private hands. This was essential to Japan’s industrial development5 and an important step towards a more capitalist system.

Japan had metallic money of gold, silver, and copper coins during the Edo period, but there were no currency exchanges, no open market for bullion. The Shōguns hardly practiced sound monetary policy and simply issued more currency whenever they needed money, seriously debasing the currency6. As a natural result of trade autarky for nearly 250 year, Japan’s valuation of precious medals did not match world prices. In the autarkic financial system that they had, the shōgunate pegged gold to silver prices at 1 to 5, whereas the world price ratio was 1 to 15.7

After Japan’s opening to trade in 1853, the country’s monetary system suffered “a period of hyperinflation, which itself played a critical role in the undermining the feudal state and bringing about the Meiji restoration… large landowners, bankers, and merchants gained, whilst peasants, urban commoners, and the lower-ranking samurai lost8.”

Edo-period Japan’s metallic coins were not its only currency; the Hans, Japanese feudal fiefs, issued their own paper currency, the hansatsu. There were no currency exchanges, but with the growth of internal trade in the late Edo period, paper currency became accepted in multiple hans9. Like Japan’s metals-based currency, the hansatsu went into a period of turmoil in the 15 years preceding the Meiji restoration.

In 1871 when the government abolished feudalism, it turned fuedal fiefs into prefectures, consolidated juristictions under a newly centralized government, and assumed responsibility for the fiefs, including expenses, which started at ¥19 million in 1871. It escalated to ¥57 million by 1872 as more fiefs transitioned to prefectures. The following year, Japan turned to the British international banking house, the Oriental Bank of London, to issue ¥10.7 million in bonds backed by rice. The funds raised were distributed as stipends to former samurai, whom the government assumed responsibility for after the hans were dissolved. The money became capital for many new enterprises started by ex-samurai10.

The first corporation in Japan, the Tokyo Exchange Firm, was founded in 1869. The Tokyo Stock Exchange, the first stock exchange in Japan, was opened in 1878. In 1877, the first Japanese bond floated for public subscription in Japan and quickly sold out.11

1.3. The Yen

The Meiji government seized the gold and silver mints throughout Japan and analyzed their assets. The government suspended all silver-back currency and forced contracts based in silver to be recalculated into gold12.

With the purchase of minting machines and the hiring of a former English mintmaster and 10 engineers from Hong Kong—then a British colony—Japan started minting its own national currency in Osaka in 1870. The Hong Kong-based mintmaster and engineers recommended a silver-back currency, due to their experience with the metal and its natural occurrence in Eastern Asia, which is more abundant than gold13.

The 1871 New Currency Act created the official decimalized currency of the Yen (basic unit), the Sen (one cent), and the Rin (one mil). The Yen was a gold coin, European states and the United States were also increasingly adopting the popular gold standard.

The Mexican Silver Dollar was a highkly favored currency used in international trade transaction in Eastern Asia , so a silver-backed currency still had its advantages for international trade. For the purpose foreign commerce, Japan created a Yen silver coin, pegged to the Mexican dollar and restricted its use to only open ports. Additionally to its peg to the Mexican dollar, the yen silver coin was pegged 100-to-101 Yen gold. In order to try and establish itself as the currency of foreign trade, at the very least within its own borders, the “trade dollar” yen was minted with a higher silver content than the Mexican dollar, 420 troy grains versus 416 troy grains14.

Silver prices dropped in 1876 on the world market as silver mines in the Western United States increased production and had new discoveries. The drop in price in silver, but not gold allowed for currency arbitrage—a trader could trade his devalued silver coins at fixed rate for gold coins whose value had not depreciated. Likewise, Japan experienced a massive outflow of gold as banks and traders exchanged their silver for gold and the open-port-only restrictions on the “trade dollar” silver-coin Yen were lifted15.

1.4. Gold Notes and other Paper Currency

The government, while establishing the gold and silver Yen coins, felt the need to issue an inconvertible paper currency, due to the nature of their limited reserves of precious metals at the time. Accordingly, between May 1868 and the end of 1869, Japan issued 48 million “gold notes.” The Gold Notes were to be redeemable in gold after a maturity period of 13 years. They were intended to be lent to clans who would use the notes to fund new enterprises. The Gold Notes were actually debt instruments used to finance the government’s budget deficit. Consequently, the value of the Gold Notes fell below their face value and the government finally halted their issuance.16

The government issued government bonds at 6% and allowed them to be exchanged for the old gold notes until 1872, this drove the gold notes back above their face values. The government issued more paper currency in the following decade until the founding of the Bank of Japan. The abolishment of the Han system and establishment of Prefectures in their place meant that the 1,694 different kinds of paper currencies of feudal fiefs, the Hansatsu, needed to be converted into a national currency. For this, another inconvertible paper currency was issued in 1871.17

In October 1881, Masayoshi Matsukata became the head of Japan’s currency and finances and immediately set out to stop the country's out-of-control inflation by converting the paper currencies into specie, paper currency backed by precious metals, and by encouraging the closing of the trade deficit by the promotion of industry. This policy became called the “Matsukata Deflation18.”

1.5. Yokohama Specie Bank

In 1880, the government organized the Yokohama Specie Bank, intended to deal in foreign trade. The bank was “the only important financial institution that did not closely follow a Western model19.” It was designed to allow Japan to continue to use its silver coin Yen and develop international trade at a time when the world was rapidly accepting the gold standard for their currencies. Like other government-established institutions in Japan, it was used “as an arm of the government’s international commercial and financial policy20.”

The bank was established for 3 million Yen. In just five years its assets increased to ¥23 million and then to ¥153 million in 1900--18 percent of the assets of all of Japan’s commercial banks, and to ¥424 in 1913--two-thirds of the size of the Bank of Japan.

During the 1930s, the bank became the government’s financial agent in the areas under military occupation. After the American entry in the Pacific war, its assets grew from ¥1.6 billion in loans in 1941 to ¥48 billion in 1944 and ¥108 billion in 1945; while is deposits in its territorial branches, mainly held by the Japanese government, grew from ¥2.1 billion in 1941, ¥32 billion in 1944, and ¥261 billion in 194521. The majority of its loans went to financing war-related production.

The bank was liquidated by the Americans and under the Foreign Exchange Bank Law, it was reestablished to a smaller extent as the Bank of Tokyo.

1.6. The Bank is Born

While on tour of Europe in 1878, France’s Minister of Finance told Japan’s Masayoshi Matsukata about the importance of a Central Bank. At that time, there were 150 national banks in Japan which could issue currency.22

In 1882, after he became Japan’s Finance Minister, Masayoshi Matsukata established the Bank of Japan. Matsukata modeled it after the Banque Nationale de Belgique.23 On October 10th, 1882 the bank opened. It was allowed to buy and sell gold, discount and buy drafts, loan money with precious metals as collateral, issue and extend credit backed by government bonds, accept deposits, but it was not allowed to issue loans for real estate or stocks24, for fear of speculation.

The first governor and vice-governor came from the Ministry of Finance (MOF), beginning a long relationship between the two institutions. Three private citizens were chosen for the board, including a former private-sector bank vice president. The shareholders in the new BOJ, beside the government, included the major Japanese banking houses like Mitsui, Yasuda, and Sumitomo25.

The 1890 Sherman Silver Purchase Act by the United States required the US to purchase 4.5 million oz of silver bullion per month28 likewise inflated the price of silver. The inflating price of silver stalled Japan’s silver-coin Yen-based economy and caused a balance of payment crisis in 189029.

While still serving as Finance Minster, Masayoshi Matsukata became Prime Minister of Japan in 1896, he advocated a switch to a gold-only standard. Japan’s victory in the 1894-5 Sino-Japanese war gave it indemnity payments from China and added Formosa (the island of Taiwan) to its territory. This mitigated the risk of moving onto the gold standard26. In 1897, Japan shifted from a de facto silver standard to a gold standard, like Western nations including the USA, the UK, France, and Germany.27

The US’s prohibition of exporting gold from the country as it entered the First World War in 1917 also had a major effect on monetary policy in Japan30. Since 1897, Japan’s gold-backed Yen had risen and fallen with other gold-backed currencies, particularly the US-dollar. Japan joined the Entente Powers at the behest of Britain at the start of World War I in August 1914. As belligerant nations scrambled to access their world reserves, the BOJ had to sell some of its gold reserves for imports in order to maintain the price of the yen, and keep it from falling below its normal price. As Japanese exports boomed during the war with other beligerant ecomomies in ruins, Japan was faced with having too much gold, which would force its currency to appreciate, so it issued debt for allied countries and bought allied debt instruments on the market in the neutral United States. 31 When the US entered World War I also on the side of Japan and the Entente Powers and imposed its 1917 gold embargo, Japan established a retaliatory embargo two days later, despite their status as allied nations at war. With the shipment of gold suspended, the Yen climbed above its gold pararity with the US dollar immediately. The Bank of Japan held ¥1.1 billion in US Dollars, held mostly in banks in the United States. Likewise, because of the embargo, it would not be able to convert these reserves into gold in the advent of a crisis. Consequently, an Exchange Investigation Committee was established to determine a new monetary policy. 32

The US lifted its embargo in June 1919, and Japan immediately converted their US Dollar reserve holdings in American banks into gold. Japan floated the Yen and kept its gold embargo until early 1930, at the beginning stages of the Great Depression and the Second Sino-Japanese War.33

In March 1920, the Tokyo Stock Exchange crashed and closed its doors for two days. It reopened and crashed more and all stock exchanges in Japan closed from April 7th until mid-May. Japan existed in a state of depression from spring 1920 to 1922. By 1923, the Yen hit its pre-war gold-parity with the dollar and Japan considered lifting its gold embargo and reestablishing the gold standard. Tragically, a devastating earthquake destroyed much of Tokyo in the spring of 1923 and the Yen fell34 again.

In the early 1930s, due to the Wall Street crash of 1929 and subsequent widespread economic depression, the collapse of China’s currency, the Bank of England’s abandoning of the gold standard, and the Manchurian Incident, the Yen did not look like it would rebound to its prewar prominence. As the Yen’s exchange rate deteriorated, Japan enacted laws to prevent capital flight and other nations imposed boycotts, tariffs, and quotas on Japanese exports due to their actions.35

The affects of Japan’s wartime monetary policy caught up with the Yen during the American occupation and Japan experienced a period of hyperinflation. On April 25th, 1949, the Yen was once again pegged to the US dollar at an exchange rate of ¥360 to $1. 36

2. Structure

2.1 The Founding of the BOJ

The Bank of Japan was established in 1882 and now operates under the latest law guiding the institution, the Bank of Japan Law of 1998.

The Central Bank would also get the exclusive right of issuing bank notes. The Bank was to issue dividends and the government was to provide half its start up capital.

The original bank charter37 provided:

The BOJ was granted a license for a period of 30 years;

Starting capitalization was ¥10 million: ¥5m from the government, ¥5m from private banks

one-fifth of the bank’s capital had to be in place before the bank could operate

The bank could not enter “risky undertakings”

The bank would not be in charge of the Treasury or its payments and receipts

The bank would have the privilege of issuing convertible bank notes, this priviledge was withheld until after 3 years of operation in 1885.

The governor and vice-governor would be granted the Imperial ranks of Chokunin-kan and Sonin-kan respectively.

The Banks credit operations, established by the Bank of Japan Regulations, were as follows38,

to discount and buy bills drawn by the government, bills of exchange, and other commercial bills;

to advance loans secured by gold and silver coin or bullion;

to allow overdrafts or grant term loans collateralized by government bonds, bills drawn by the government or securities guaranteed by the governments for operations falling under the amount and interest rate required the of the MOF

Although the bank was not supposed to be in charge of “the Treasure or its payments and receipts,39” It did just that within a few years. In 1922, the Treasury was reformed and its funds were treated like any other government deposit.

After World War II, the Bank was reformed to be more independent of the government.

2.2 The Bank of Japan Law

The current Bank of Japan Law, enacted in 1998 reads40,

Article 1

The objective of the Bank of Japan, as the central bank of Japan, is to issue banknotes and to carry out currency and monetary control.

In addition to what is prescribed by the preceding Paragraph, the Bank's objective is to ensure smooth settlement of funds among banks and other financial institutions, thereby contributing to the maintenance of an orderly financial system.

The principle of currency and monetary control

Article 2

Currency and monetary control shall be aimed at, through the pursuit of price stability, contributing to the sound development of the national economy.

The Bank’s Capitalization is set at ¥100 million, with the government owning 55%. The bank’s governor and vice-governors are chosen by the cabinet and approved by both the House of Representatives and the House of Councilors. Their terms are 5 years and they cannot be fired unless they are incompetent, quasi-incompetent, or bankrupt or they are guilty of a crime or physically incapable. The governor has the right to appoint the staff of the bank,

The Bank of Japan Law's Article 4 is controversial; the Bank in the past has been accused of being an extension of the Ministry of Finance. It reads41,

“In recognition of the fact that currency and monetary control is a component of overall economic policy, the Bank of Japan shall always maintain close contact with the government and exchange views sufficiently, so that its currency and monetary control and the basic stance of the government's economic policy shall be mutually harmonious.”

Article 19 also deals with its governmental interaction at the BOJ, The Minister of Finance and the Minister of Economic Planning Agency can attend BOJ board meetings and state their opinions, ask for votes to be postponed.

3. War Bank

In 1937, the Emergency Fund Adjustment Law required private banks to steer their funds towards critical industries, doubled the Industrial Bank's underwriting limit, and encouraged public savings bonds for the general public to buy and absorb the national debt. In 1940, representatives of the BOJ, MOF, Industrial Bank, and the Planning board formed the Bond Issue Council, which took control of the bond issue market42.

4. That Yen

Between 1953 and 1973, Japan experienced near 10 percent GDP growth per year.43 In 1963, Japan become an ‘Article 8’ member of the International Monetary Fund. This allowed Japanese citizens to convert the yen for all trade. The Yen was still pegged, 360¥ to the dollar, and from 1960 to 1966 the yen’s purchasing power parity grew against the dollar by 30 percent.44 Meanwhile, in 1966, Japan surpassed West Germany and became the world’s second largest economy.45

In 1971, the United States under President Richard Nixon pulled out of the Bretton Woods Agreement of 1950, which pegged currencies against each other and to an extent--gold. Japan revalued the Yen briefly from December 1971 to February 1973 at 300 Yen per dollar. After the BOJ abandoned the peg, the Yen began rapidly appreciating further against the US Dollar, then tumbled, then gained in value again from 1976 until fall 1978 against the dollar and against the Deutschmark as well.46

4.1 Crisis

The Yen peaked in 1978 and then fell until the Second Energy Crisis triggered by the Islamic Revolution in Iran. Interest rates in the US rose and Japan gained a trade deficit. From 1985 until the Wall Street crash of 1987, the Yen appreciated against the dollar 100 percent.47

From 1988 until early 1990, the Yen fell in value 20 percent. This was the beginning of the end to Japan’s “bubble economy.” In 1990, before the Japanese real estate bubble burst, the value of the land in Japan was worth about 4-times as all the land in the United States. That year, the Tokyo equity market fell 25%. Real estate prices dropped 20-30% in Tokyo. Credit rating and analysis began downgrading Japanese banks and stocks due to their overexposure in the overvalued real-estate market. Banks were heavily into real estate loans, 14.9 percent of banks’ assets in 1991.48

After the burst of the Japanese real estate bubble and bottoming of the market, the Yen then appreciated 60% overall, but then plummeted again from 1995 to 1998 . The BOJ had to worry about deflation. This April [2007], Consumer Prices Dropped 0.1 percent, in March Consumer Prices Dropped 0.3 percent, this suggest deflation may have bottomed and the Yen is ready to appreciate in value again.

4.2 BOJ and the Zero Interest Rate Policy

The Bank of Japan sets interest rates and for a good part of the first half of this decade, it has been at a zero or near-zero percent rate since the late 1990s. One of the objectives of the Bank of Japan is to stimulate the Japanese economy, which has been in a recession since the early 1990s. In July 2006, the discount rate was raised from zero to 0.25%49. Japanese Finance Minister, Sadakazu Tanigaki, opposed the raise in rates from 0%, feeling the country's economy was not ready.50 The BOJ had tried raising rates above zero before, it had eased off of 0% in 2000 for a year, but it resulted in more downturn. By contrast, US Fed Rate is at 5.25% [2007]. Today the economy “grew in each of the past five quarters while unemployment has fallen to an eight-year low of 4%”.51

5. BOJ and the USA

In 2002 during the recession in the United States, there were worries in the US about possible deflation. Ben Bernanke, then an economic adviser, gave a speech where he encouraged printing money to fight deflation (he became Chairman of the Fed in 2006). He repeated it in the speech in Japan in 2003.

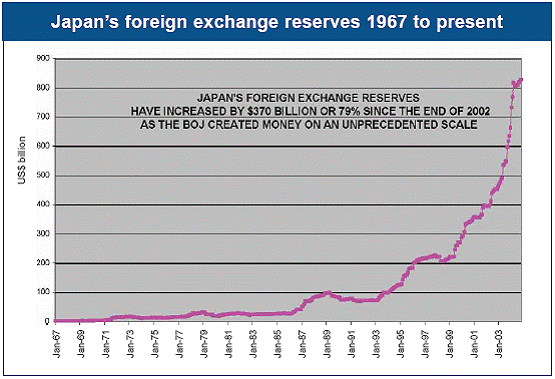

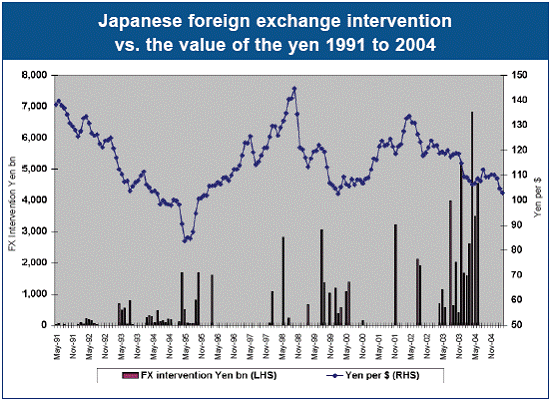

In 2003 and the first quarter of 2004--over those 15 months--monetary authorities in Japan created 35-trillion Yen. There was no shortage of currency, interest rates were already low, national savings were high, national demand for loans were low, and retail banks are required to put reserves into low-yield government bonds (JGB). To get how much ¥35 trillion is in context, one must know what it is, ¥35 trillion is $2,500 for every person in Japan. ¥35 trillion is $50 per person in the world. It ¥35 trillion is about 1% of the world's annual economic output.

BOJ gave the ¥35 trillion to the Japanese Ministry of Finance for MOF debt with virtually no yield; MOF in turn, used the money to buy ~$320 billion from the private sector. The MOF then invested those dollars into US dollar- denominated debt instruments such as government bonds and agency debt in order to earn a return. Writing on the matter, Richard Duncan--the peak-resources theorist--had this to say, “the Bush tax cuts and the BOJ money creation that helped finance them at very low interest rates, were the two most important elements driving the strong global economic expansion during 2003 and 2004.”52 The cuts “and low interest rates fueled consumption in the United State.” Once there were implemented, “US consumption shifted Asia's export-oriented economies into overdrive”

In 2003, China had a $124 billion trade surplus with the US. In 2004, It had a trade surplus with the US of over $160 billion but a large trade deficit with Japan. In turn, China used the US Dollars paid to it from its exports to America in order to pay for its trade deficits to Japan and other regional states.

Chart: Richard Duncan (http://www.richardduncaneconomics.com/)

Chart: Richard Duncan (http://www.richardduncaneconomics.com/

The US entered a recession in 2000, and foreign money started leaving the US thereafter as the Strong-Dollar trend of the 1990’s ended. In 2002, the US Dollar peaked before descending. In 2003, as the dollar declined, the Japanese Ministry of Finance started buying US debt as the dollar declined. The Dollar versus the Yen bottomed out in 2004 and the Dollar began rebounding.

Japan’s economy started turning around, too. Japan had major cash inflows starting in 2003--a major change. In May 2003, cash outflows were $23 billion in the first quarter of 2004, when the MOF stopped by bonds, it was -$37 billion per month.

Had the BOJ/MOF had not bought the US Treasury Bonds, the US might have had a balance-of-payment crisis and would have to deal with its trade deficit. The US would have depleted its reserves and raised interest rates and interest rate hike would quell consumption, causing a worldwide slump. Central Banks in countries with a trade surplus with the United States, like Japan and China, buy US Treasury Bonds to prevent their currency from appreciating against the USD. The money is recycled in USD-denominated assets, such as electronic goods. While the dollar started trending-downward, and the private-sector started leaving the dollar. The European Central Bank (ECB) allowed the Euro to appreciate versus the dollar. Subsequently, Japan and China decided to print Yen and Yuan (RMB) and devalue their currencies contra the US dollar and Euro.

By March 2004, Japan stopped buying US debt, but by March 2004 the US was experiences robust economic growth. By Summer, due to increased tax revenue, the estimated budget deficit was revised from $521 billion to $445 billion. The US Fed indicated it would start to raise the interest rate again and it raised interest rates that summer. This stopped the private-sector run on the dollar. The BOJ's massive purchase of US debt was also the result of a central bank with few options, as with interest rates at zero, central banks have few conventional choices to stimulate the economy and traditional monetary policy becomes irrelevant.

1 Adams, T.F.M. A Financial History of Modern Japan. 1964. RESEARCH (Japan) Ltd. Tokyo, Japan. p1

2 Goldsmith, Raymond. The Financial Development of Japan, 1868-1977. 1983. Yale Unversity Press.New Haven, CT. p17

3 Adams, T.F.M. A Financial History of Modern Japan. p2

4 Ibid, p3

5 Ibid

6 Brown, Brendan. The Yo-Yo Yen and the Future of Japan’s Economy. 2002. Palgrave. London, UK. P5

7 Picker, Anne. International Economic Indicators and Central Banks, John Wiley & Sons. 2007. Hoboken, NJ. P55

8 Ibid, p6

9 Bank of Japan online. “Paper Money in Japan, 2-3 Hansatsu(II) : From The Lifting of the Ban in 1730 to the Late Edo Period.” <http://www.imes.boj.or.jp/cm/english_htmls/feature_gra2-3.htm>

10 Adams, T.F.M. A Financial History of Modern Japan. p21

11 Ibid, p22-300

12 Ibid, p5

13 Ibid

14 Ibid, p6

15 Ibid

16 ibid

17 Ibid, p7

18 ibid

19 Goldsmith.. The Financial Development of Japan. p50

20 ibid

21 Ibid, p118

22 Adams, T.F.M. A Financial History of Modern Japan. p14

23 ibid

24 Ibid, p15

25 ibid

26 Brown. The Yo-Yo Yen and the Future of Japan’s Economy p15

27 Ibid, p12

28 “Sherman Silver Purchase Act”, wikipedia.org

29 Adams, T.F.M. A Financial History of Modern Japan. p18

30 Brown. The Yo-Yo Yen and the Future of Japan’s Economy p16

31 Ibid, p 16-18

32 Ibid, p18-20

33 ibid

34 Ibid p22-23

35 Ibid p26-27

36 Ibid, p28

37 ibid

38 Ibid, p16

39 Ibid, p15, p17

40 http://www.mizuho-sc.com/english/ebond/law/boj.html

41 ibid

42 Adams, T.F.M. A Financial History of Modern Japan. p115

43 Brown. The Yo-Yo Yen and the Future of Japan’s Economy p30

44 Ibid P31

45 Ibid p32

46 Ibid p31

47 ibid

48 Gup, Benton. Bank Failures ob the Major Trading Countries of the World. 1998.. Quorum Books. Westport, CT. p36

49 BBC, “Japan scraps zero interest rates”, http://news.bbc.co.uk/2/hi/business/5178822.stm

50 BBC, “Q&A: Japan’s Interest Rates”, http://news.bbc.co.uk/1/hi/business/5178610.stm

51 ibid

52 “How Japan financed global reflation” Richard Duncan